Wondering how to receive a hefty tax credit when you make your electric car purchase? With the current federal tax credit for electric cars, you may be able to receive a credit of up to $7,500. Add on a home charger tax credit and state-level incentives, and purchasing an electric car might seem like a no-brainer.

But before you run off to your local dealership, it’s important to understand the terms of the federal tax credit—which have changed dramatically over the past few months with the Inflation Reduction Act. While speaking with a tax professional is always the best option, we’ll do our best as electric car enthusiasts to walk you through the tax credit details and explain how you can maximize your savings.

How to Qualify for an Electric Car Tax Credit for Car Purchases in 2021 and 2022

If you’ve already bought an EV in 2022 or are planning to before the end of the year, the tax credit terms are fairly straightforward and are mostly unchanged by the Inflation Reduction Act. The tax credit ranges from $2,500 – $7,500 based on the electric car’s battery capacity.

To qualify, you must:

1. Purchase a new electric car that weighs less than 14,000 pounds. (Used and leased cars do not qualify.)

2. Purchase from a manufacturer that has sold fewer than 200,000 qualifying vehicles. (Tesla and GM have already exceeded this limit.)

3. Purchase your car between January 1, 2010 and December 31, 2022.

4. Purchase a car with at least 5 kilowatt hours of capacity. (Larger capacities will get you a larger credit—up to $7,500)

Note: If you purchase your electric car after August 15, 2022, your electric car must have its final assembly in North America to be eligible for a credit.

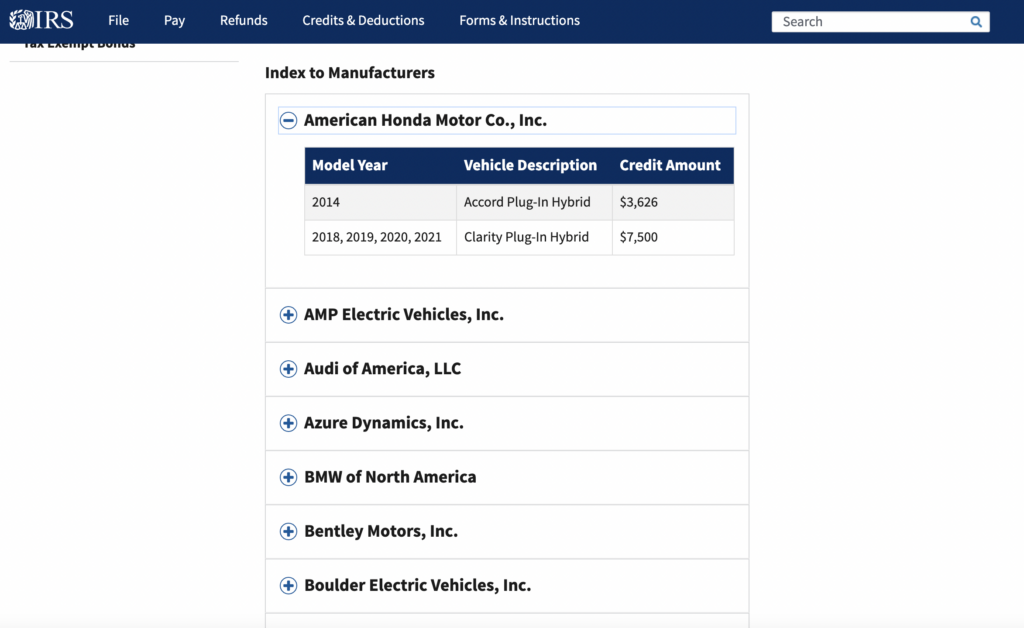

If you’re unsure if your electric car will qualify, head over to the IRS website for an easy-to-read index of manufacturers so you can see which cars qualify and for how large a credit.

What Changed With the Inflation Reduction Act?

To put it simply, a lot. Starting off with the good news, the Inflation Reduction Act (IRA) extended the lifespan of the federal tax credit by nine years so you may be able to get tax credits of up to $7,500 on purchases made anytime from now to 2032. This speaks to the Act’s goal of supporting electric vehicle adoption in the U.S.

On the other hand, the IRA also seeks to invest in domestic energy production and manufacturing. The key word here is domestic and the majority of EVs available today will no longer qualify for tax credits starting in 2023. As we said, there are a lot of changes with the new bill—but we do anticipate many manufacturers making internal changes in order to meet the new tax credit qualifications.

Here are the tax credit changes coming in 2023 as part of the Inflation Reduction Act:

1. A credit of up to $3,750 will rely on the car battery being at least partially made or assembled in North America.

2. An additional credit of up to $3,750 will rely on key materials (such as lithium, nickel, and cobalt) at least partially being mined or processed by a U.S. free-trade partner or obtained through electronics recycling in North America.

3. Used electric cars are now eligible for the tax credit. (Up to a $4,000 credit)

4. Manufacturing caps will be lifted. (Large EV manufacturers such as Tesla and GM can now qualify for tax credits again.)

5. There are vehicle price cut-offs to qualify for the credit. (Cutoffs are: $55,000 for new cars and $80,000 for new SUVs, trucks, and vans.)

6. There are income cut-offs to qualify for the tax credit. (Cutoffs are: $150,000 for individuals, $225,000 for heads of households, and $300,000 for joint fillers.)

The bill lays out further changes beyond 2023—including increasing the portion of assembly, manufacturing, and mining done in North America for cars to qualify for the tax credit. The bill will also exclude cars with any battery components coming from China starting in 2024.

While many of these exclusions seem counterproductive to driving electric vehicle adoption, the aim is to support domestic production, improve the supply chain, and ultimately boost the American economy over the next decade.

Which Electric Cars Qualify for the Tax Credit Now?

As we mentioned before, currently few cars are meeting the new requirements laid out in the Inflation Reduction Act for 2023. We anticipate this list to grow exponentially over the coming months and years.

Currently, here are some of the major electric vehicles that could qualify for the tax credit in 2023:

Electric Cars Assembled in North America That May Qualify for the 2023 Tax Credit

| 2023 Cadillac LYRIQ |

| 2022-2023 Chevrolet Bolt EV |

| 2022 Chevrolet Bolt EUV |

| 2022 F-150 Lightning |

| 2022 Ford Mustang MACH E |

| 2022 + 2022 Nissan Leaf |

| 2022 Tesla Model 3 |

| 2022 Tesla Model S |

| 2022 Tesla Model X |

| 2022 Tesla Model Y |

We’ll be watching for an updated list of qualifying vehicles from the IRS website to add in early 2023.

Do Teslas Qualify for the Tax Credit?

While Tesla has already met its qualified vehicle cap for 2022, starting in 2023 Teslas will be eligible for the new tax credit. Eligibility is based on Tesla models meeting the price requirements and buyers being within the income limits mentioned above.

Are There Other Tax Credits Available?

Yes. Many states are offering rebates and incentives to buyers to further boost EV adoption. California, for example, allows buyers to combine the federal credit with a rebate or grant as part of their Clean Vehicle Assistance Program. That said, read the fine print because depending on the state you may not be able to combine state and federal incentives in one purchase. Electrek has a nice roundup of incentives offered at the state level for you to review.

You may also be able to qualify for a federal credit for your electric car home charger. A $1,000 credit or 30% of the charger’s cost (whichever is smaller) is available and can be submitted to the IRS with Form 8911 when you do your income taxes. Again, look into local incentives here as well to ensure you get the best deal possible.

How Do You Claim Your Electric Car Tax Credit?

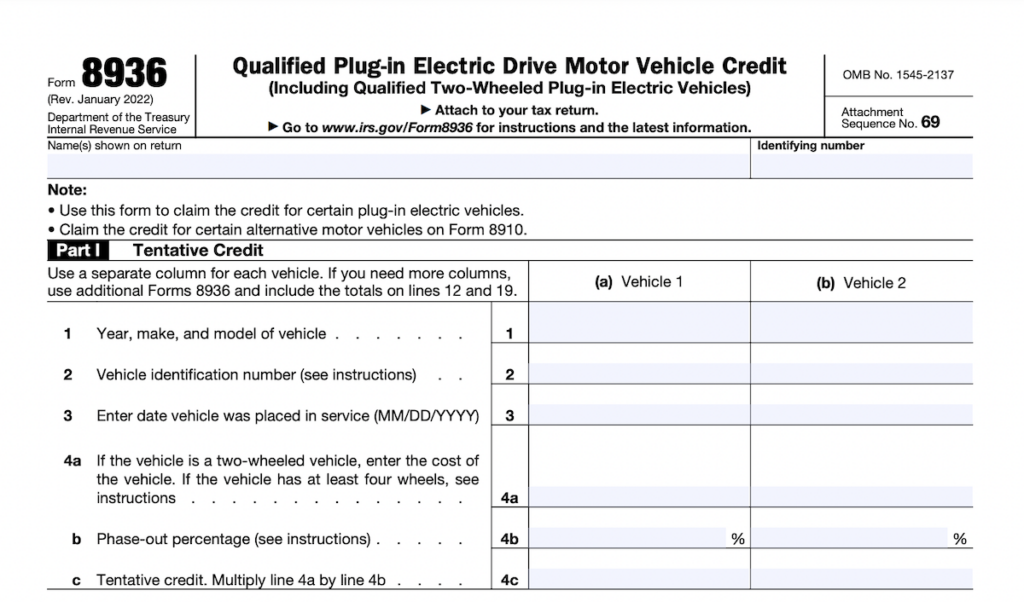

To claim your federal tax credit, you file Form 8936 with your income taxes. You can only claim one credit for one vehicle per year. Note that is a tax credit and not refundable meaning it can only be used to pay off a tax bill. If you do not owe taxes or you owe fewer taxes than your tax credit, you can use only what you need to pay the taxes owed. However, starting in 2024, you will be able to use the credit at a dealership when you make your electric car purchase.

Does the Credit Make an Electric Car Worth It?

The tax credit for electric cars is a bit confusing—especially with changing qualifications coming with the Inflation Reduction Act. There are now quite a few more requirements in terms of income limits and purchase prices. That said, $7,500 is nothing to scoff at, and with many electric cars now rolling out under the $35,000 price point, the financial commitment and gas savings make electric cars look like a pretty good option financially.

While electric cars are becoming more mainstream, they are still in their infancy so it’s worth thinking through the full costs and true pros and cons before leaping at the chance for a hefty tax credit.

Final Thoughts

Considering the Inflation Reduction Act was only passed a couple of months ago, we’re still watching to see how things shake out and to see which vehicles will end up qualifying for the tax credit in 2023 and beyond. Unless you have your heart set on a model that won’t qualify, you don’t anticipate owing taxes, or you exceed the income limit, the electric car credit is absolutely worth looking into and could provide a great benefit to new electric car owners.

Leave a Reply